Combination trades are a type of trading strategy employed in the financial markets, and they have become increasingly popular due to their potential for high returns. In essence, combination trades involve the simultaneous purchase or sale of two different types of assets, such as stocks and options contracts, to take advantage of price movements between them. Combination trades offer investors a way to diversify their portfolios while reducing risk. In Britain, traders can access combination trades through various online brokerages. Traders need to open accounts at these brokers and deposit funds to trade. Once funded, traders can place orders for stocks and options (or other assets) using the same account. When placing orders, considering the market’s direction and other factors, such as implied volatility, is essential.

The different types of combination trades

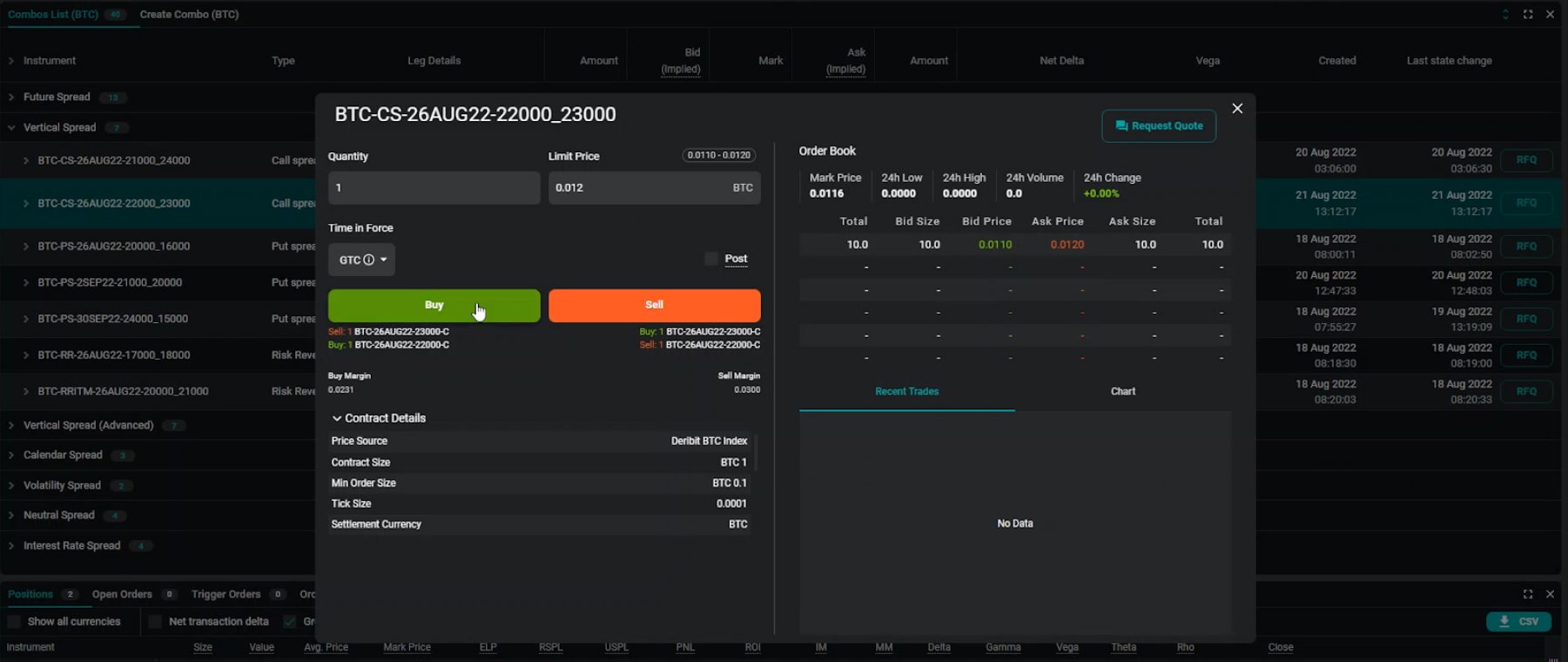

Traders should also be aware of different types of combination trades, such as straddles, strangles, condors, butterflies, and vertical spreads. Straddles and strangles are buying (or selling) options contracts at two strike prices to take advantage of price movements between them. Condors involve buying calls or put with four different strike prices, while butterflies believe in two rings or put with three different strike prices. Vertical spreads are a spread options strategy where a trader buys one call or puts at a higher strike price, then sells another call or puts at a lower strike price. These strategies allow traders to generate profits in both up and down markets.

Using combination trades for hedging

Combination trades can also be used as a form of hedging. Hedging is a risk management technique involving purchasing an asset that moves inversely with another acquisition to reduce or mitigate losses should the price of the original asset fall. Combination trades can also be used as part of more complex hedging strategies. Combination trades can also be used as part of more complicated hedging strategies. For example, suppose a trader owns shares in company X and is worried about a drop in share prices. In that case, they could buy a put option on those shares, effectively buying insurance against future losses due to market movements.

Are there any risks associated with using combination trades?

Combination trades come with risk, as with any other trading strategy. When using combination trades, traders are exposed to additional risks due to the increased complexity of the system. For example, due to the simultaneous purchase or sale of two different types of assets, traders may find themselves overexposed to specific markets or asset classes, leading to higher losses if prices move in an unexpected direction. Similarly, straddles and strangles increase the risk that one option will expire and be worthless while the other will be profitable.

In addition, when using combination trades, there is a greater likelihood of incurring transaction costs due to the frequent buying and selling of multiple positions. These costs can quickly add up and reduce gains from successful positions. Furthermore, depending on the strategy’s sophistication, combination trades may incur extra taxes such as stamp duty or capital gains tax (CGT), further reducing profits in some cases. It is also vital to note that when using combination trades, there is no guarantee of success when you are options trading; even if a trader selects the right strategy and accurately predicts market movements, it does not guarantee positive returns.

Factors such as market volatility and liquidity can make it impossible for traders to predict price movements with certainty accurately. Finally, traders should also be aware that it can be difficult for inexperienced traders to accurately assess risks associated with combination trades due to their complexity. Consequently, it is strongly recommended that new traders carefully research each strategy before attempting them to avoid making costly mistakes that could result in significant losses.

Conclusion

Combination trading offers investors an opportunity to diversify their portfolios while reducing risk. Using different types of combination trades, such as straddles and condors, investors can take advantage of market movements while protecting themselves against potential losses. Combination trades can also be used as hedging strategies to reduce risk further. As with all investments, it is essential to research before trading and ensure that you understand the risks involved. With the proper knowledge and strategy, combination trades can offer substantial returns in the financial markets.